In The War on Jobs 2 (20 July), I wondered about how we should respond to the current economic crisis and if there are lessons we can learn from what happened in Argentina in 2002. But why Argentina eight long years ago? Why not an example nearer to home and more recently, such as Greece last May? After all, the Greeks protested in their hundreds of thousands against the savage cuts their government proposed to make under severe pressure from the IMF and those cuddly market speculators we all love. Well, there’s an important difference.

Greece says “Ochi!”

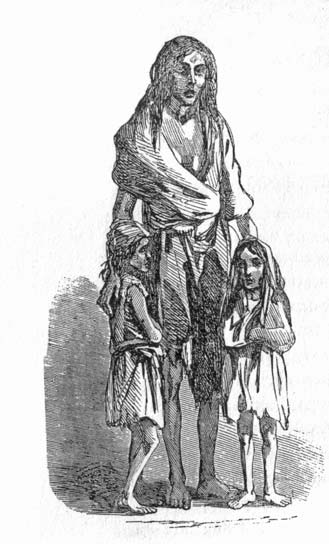

For all its troubles and its scandalous treatment at the hands of the international “community”, Greece still stands. Argentina in 2002 was on its knees. The circumstances that led to its collapse are eerily familiar when we look at what’s happening to Greece Portugal, Ireland and Spain – what the markets so charmingly call the “PIGS”.

But the response of the Argentinian people in 2002 was of a different order to the kind of brief explosions of anger we’ve seen in Europe these past few months. It was a mass popular uprising that crossed class lines and that was symptomatic of the shift in politics that was happening right across the continent – in Venezuela, Bolivia, Brazil and Chile to name just a few countries – where people decided to fight back against the global capitalist order that was robbing them of their livelihoods and their dignity.

The IMF in Argentina: The Biggest Bank Robbery in History

The collapse of Argentina’s economy in 2002 was a long time coming but not inevitable. It came about after twenty years of IMF-imposed stringency measures aimed at repaying the country’s external debt. For a more detailed account of these measures, see this article by Joesph Halevi in the Nation magazine online, but essentially they amounted over time to a wholesale raid on the public purse that ravaged social services and put up to 18% of the population on the dole and another 18% into underemployment – that’s 14 million people in total and the equivalent of 22 million people in the UK. It also involved a partial freeze on the bank accounts of ordinary citizens (with a limit to withdrawals of US$250 per week), leaving them in financial hardship almost overnight. It was the culmination of a concerted heist that Halevi describes as follows:

In essence, during the last twenty years [up to 2002], the Argentine population has been subjected, in sequence, to the following mechanism. The state takes upon itself the burden of the private external debt. The private sector keeps running up additional debt, while the state sells out its public activities through privatization policies, thereby generating financial profits (rents) for the private corporations whether national or international. The state then unloads the burden of debt onto the whole economy, especially the working population, by compelling the population to deliver a financial surplus at the expense of wages, social services, and public investment”.

This sounds rather familiar when we think of what’s happening right across the world today. Compare it, too, with Henry Liu’s diagnoses as cited in my post, And Now the Markets 2 (12 July).

So how did the people of Buenos Aires and beyond respond to this raid on their livelihoods and financial security? Did they form orderly queues outside their banks and shout a bit or murmur mild irritation, as did the customers of the British bank, Northern Rock, when it collapsed in July 2008? Did they write to their MP or take part in TV programmes like Question Time or the Jeremy Kyle Show? No. This is what they did…

Taking back control

Popular resistance to the economic destruction wrought by government policies had already taken root in the country before 2002. The mid-1990s saw the emergence of roaming picketers or piqueteros, so-called for their practice of barricading streets, roads and highways in their locale and bringing transport to a halt. Most piqueteros were unemployed so this was their only avenue of protest against the economic policies that had impoverished them. As John Jordan and Jennifer Whitney point out in their excellent eyewitness account, Qe Se Vayan Todos: Argentina’s popular uprising, the remarkable thing about the piqueteroes was the extent of popular support for their seemingly destructive tactics. Essentially, they presaged the uprising to come.

Argentina says “Qe se vyan todos!”

By 2002, the increasingly savage cuts to the public sector had pushed thousands of people onto the streets to join the piqueteroes in saying no to the government, their economic advisers, the established political parties and the IMF. “Qe se vyan todos! “ became the rallying cry. “All of them must go!” And it was this widespread feeling that the political classes had failed them that led to the creation of autonomous local assemblies, leading the Pope to voice the alarm of the established order by declaring Argentina to be in a “pre-anarchic” situation. Anarchy for the Pope, the Argentinian government and the IMF was the collapse of social order, chaos and violence in which it is difficult to do business. Anarchy for the people, though they did not all label it as such, was about taking back control of their lives, establishing cooperative structures, bartering their skills and services, occupying and running their factories, and rediscovering the meaning of community and neighbourhood. An elderly shopkeeper told Jordan and Whitney:

Never in my whole life did I give a shit for anyone else in my neighbourhood. I was not interested in politics. But this time I realized that I had enough and I needed to do something about it.”

Forget about mainstream media accounts of the uprising in Argentina which operate within the confines of the conventional wisdom that says people power of this kind is only legitimate when it challenges the evil regime on the other side of the world. Think, for example, of the difference between media coverage of people power in Eastern Europe in 1989 and people power the very next year in Britain against the poll tax. No. If you want to really understand what happened in Argentina, then Jordan and Whitney’s inspirational article is an essential primer for further reading.

Britain says “No thank you very much!”

So what shall we do?

“What shall I do with this new and coming hour, so unfamiliar to me?”

Federico García Lorca (1898-1936)

Of course, the uprising has had its critics within the fractious theoretical left, some of which are as afraid of this kind of people power as the established capitalist order. But the essential point they miss is this. What happened in Argentina in 2002 gave a lie to the fundamental principle of neo-liberalism: that there is no alternative. What the piqueteroes, the mass protests and the local assemblies showed was that there was an alternative; that, as Jordan and Whitney argue:

A choice does exist, despite the government’s blind adherence to the demands of the IMF…between sovereignty and occupation, between the local desire of people and the global demands of capital, between democracy and empire, between life and money, between hope and despair.”

Obviously, we can’t lift the specifics of the uprising and apply them wholesale to our present circumstances and possible fate in time to come but when the global financial capitalists broke down the door in Argentina and said to the people, “We are your masters now!”, the people said, “You think?”

And while we sit around thinking and debating about the destruction of democracy in our countries by the IMF and the market speculators they serve, the people of Argentina at least did something to try and take their country back. As Jordan and Whitney conclude, the lessons for us all are clear:

Perhaps the most realistic thing to imagine at the beginning of this already war-torn century, is a system free of capitalism, one without banks, without poverty, without despair, a system whose currency is creativity and hope, a system that rewards cooperation rather than competition, a system that values the will of the people over the rule of the market. One day we may look back at the absurdity of the present and remember how the people of Argentina inspired us to demand the impossible, and invited us to build new worlds which spread outwards from our own neighborhoods.”

So when we, like Frederico Lorca, ask what shall we do in this unfamiliar hour, as these cuts begin to bite and as we pay the price for the neo-liberal pillage of our public welfare, what will our answer be? Let’s hope our intellectual pessimism hasn’t quashed our optimism of will.